If you’re in the market to buy commercial real estate, you’ve probably heard the terms tossed around like “Class A Office Space” or “C-Class Facility in up & coming market!”.

And if these terms confuse you, you’re not alone.

Defining Classes of real estate can be an extremely subjective topic. There is no bureau or single agency that assigns a class to any one property. And because there’s no standardization, that leads to plenty of grey-area.

Why are there different categories of asset classes?

Each category from A to C represents a varying level of price, quality, location and amenities offers for that type of asset. By defining assets by class, it helps buyers, sellers & brokers understand the asset at a glance. This in turn, helps define strategies and thesis’s such as “we only buy Class-B properties”.

What factors go into defining an asset class standard?

The tricky part here is that these are all subjective.

A Class C property in a hub like NYC might actually be Class B in a more tertiary market. The Classes are extremely dependent on what the neighboring competition looks like.

Factors that go into determining asset class grade include:

- Date of build

- Amenities

- Location within a city

- Tenant income

- Finish of building

- Growth potential

Class A

- Newest developments, often built in the last 10 years

- Come built with the most luxury and amenities

- Typically in dense high-earning markets (NYC, LA, Chicago)

- Often have superb professional management in place

- Able to charge the highest rents in the market

Class B

- Built in the last 10-20 years

- Some deferred maintenance

- Lower income tenants relative to Class A properties

- Sell for a lower $/SF than Class A properties

Class C

- Typically built 20+ years ago

- Structurally sounds but cosmetically not perfect

- Often in tertiary markets (Odessa, Ithica, Lincoln) with potential crime issues

- Generally need sizable CAPEX repairs

- Heavy value-add opportunities

How Do Class Types Impact Commercial Real Estate Investors?

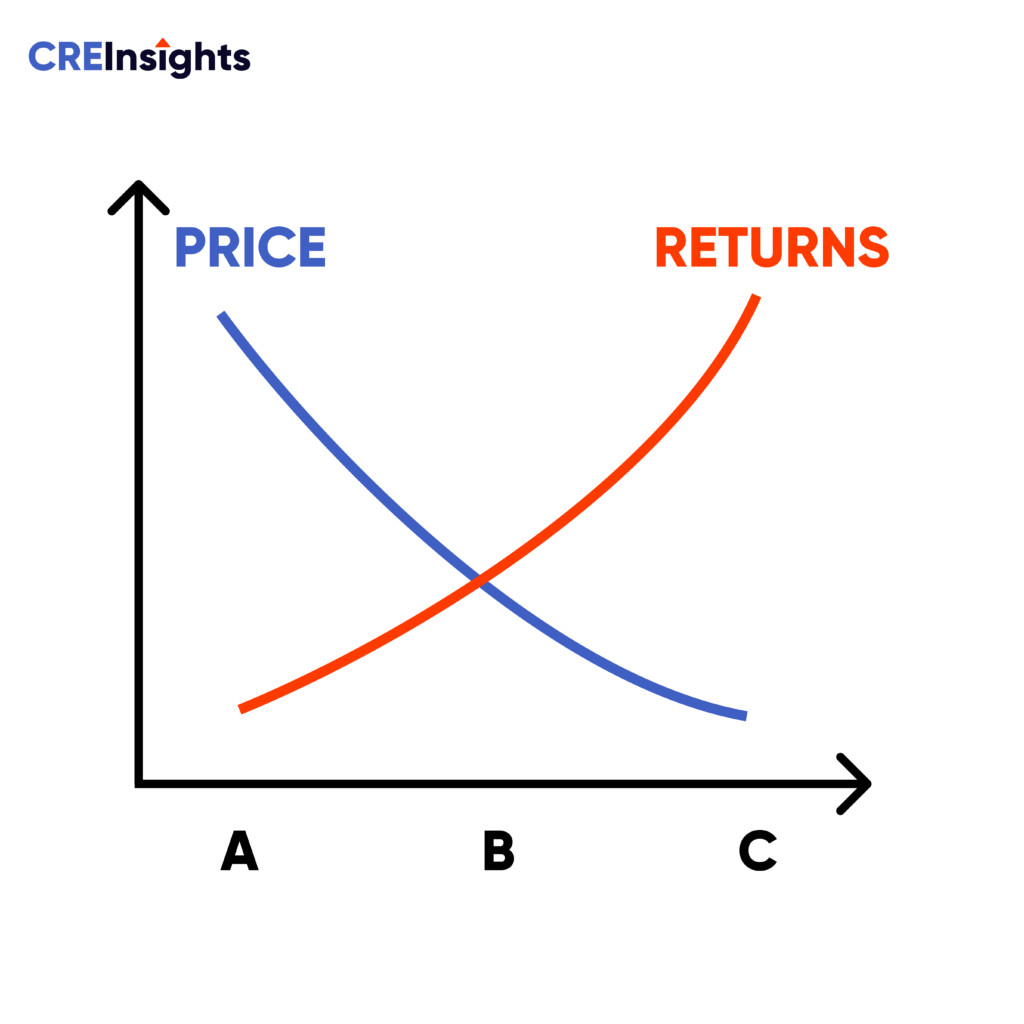

Generally speaking, the worse the asset class, the higher return impacted.

Similar to the correlation between risk & reward, more effort is needed to repair or maintain a C Class building compared to an A Class property. Therefore the owner should be compensated more on a risk-adjusted return basis.

Compare that with Santa Monica beachfront property in Los Angeles – there’s lower perceived risk therefore a lower return on investment.