What is a GP in Real Estate?

A GP stands for General Partner, also commonly referred to as a Sponsor of a deal.

This is an individual or an entity who typically finds and puts the entire real estate deal together. This includes everything from sourcing the property, finding the capital (both debt & equity), making the day-to-day decisions on the property, and most importantly being liable for the property.

Common GP Responsibilities:

- Sourcing the property

- Underwriting the deal to forecast returns

- Get the deal under contract

- Negotiate purchase & sale agreements

- Perform standard due dilligence

- Secure financing (either bank debt or private equity or both)

- Close on the property

- Manage it to the proforma set

- Investor communications

- Dispose of asset

- Pay distributions to investors

What is an LP in Real Estate?

An LP or Limited Partner, is an individual who has limited liability in a real estate deal. Their main contribution towards a deal is primarily capital, and they have little to no day-to-day involvements with the operating and management of a property.

Limited Partners are a common role in the world of Real Estate Private Equity because they are often the closest thing to true passive income when investing in real estate outside of purchasing shares of a public REIT.

3 Core Traits You’ll Find of an LP:

- Limited Liability – If the property defaults and declares bankruptcy, the individual who is an LP rarely is liable with their personal assets compared to the GP who holds the guarantee.

- Passive Nature – Because they are contributing capital into the deal, they are hardly ever the one to answer the phones, management the building, and be involved in daily decision making

- Profit Sharing – LP’s will invest in a real estate deal typically for the profit sharing element agreed upon on the onset of the deal.

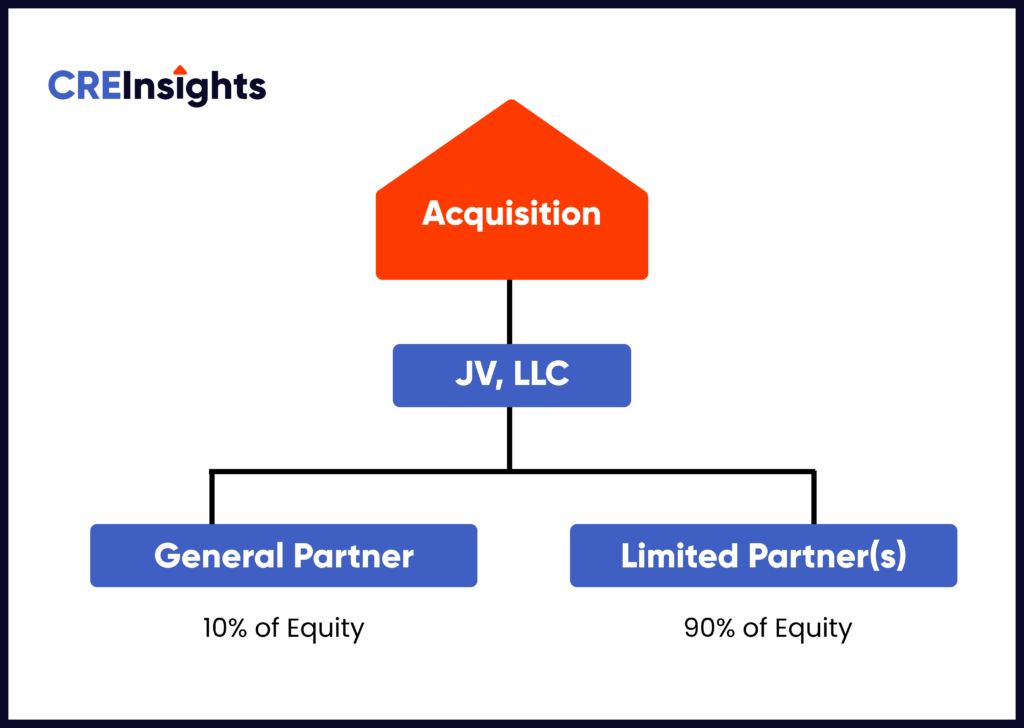

Common GP & LP Structures

There are infinite ways to structure a GP/LP deal structure, but below are some common terms and numbers used in the industry:

Equity – LP’s main responsibility is putting up the vast majority of equity in a deal. If a property costs $10M and a $2M downpayment is required, it’s very common for an LP to put up nearly 90% of that equity ($1.8M) while a GP puts down the remaining 10% ($200k).

Preferred Return – This is the yield an LP can expect to receive often from distributions alone but sometimes from the disposition of the property. Depending on the market, this can vary from 6-10% based on asset class and interest rates. Using the same deal above, if there’s a 7% preferred return and the property produces $200,000 in NOI in the first year, the LP can expect to receive the first $126,000 before the GP sees a dollar.

Promote – The promote is the GP’s share of the profits above a preferred return. This structure can be anything from 80/20 (In favor of the LP) to 50/50. In the 50/50 example using the numbers above, the GP could expect to receive $37,000 that first year from $200,000 in NOI after that preferred return is paid out.

Acquisition Fees – It’s common for a GP to take a 1% acquisition fee for finding and closing the deal

Management Fees – It’s common for a GP to take a 1-2% management fee for the work that they are doing to manage the property and pay their team

How To Find a GP

Some of the best ways to find a GP is simple to cold email different funds & syndicators and learn about their investment strategies and historical returns.

If you are looking to become an LP and invest passively into other general partners deals, you can source & vet different GPs and their deals directly on CREInsights.